- Technology for Resource Management

- Posts

- A Great time for Energy In the US

A Great time for Energy In the US

Consolidation, Government Investment, Huge Opportunity for Wholesale

Wholesale Fuel Insights: Riding the 2025 Wave

The Majors are investing across the board right now but what does that mean for wholesalers operations and remaining competitive in consolidation, pursuing scale to lower costs and more efficient distribution.

Majors like Exxon, Chevron, and Shell are ramping up M&A in upstream, midstream, and renewables, with deals up 2-4% in value and volume, focusing on shale, divestitures, and tech for energy transition.

Now imagine your trucks rolling smoother amid rising fuel demands yet dodging hidden potholes like shrinking gas profits. That's 2025's oil and gas scene for us wholesalers across America. As we hit mid-year, consolidation through mergers is reshaping the industry, making big players bigger while we adapt to stay nimble. Upstream saw mega-deals like ExxonMobil's $60 billion Pioneer buy, boosting efficiency but squeezing smaller suppliers.

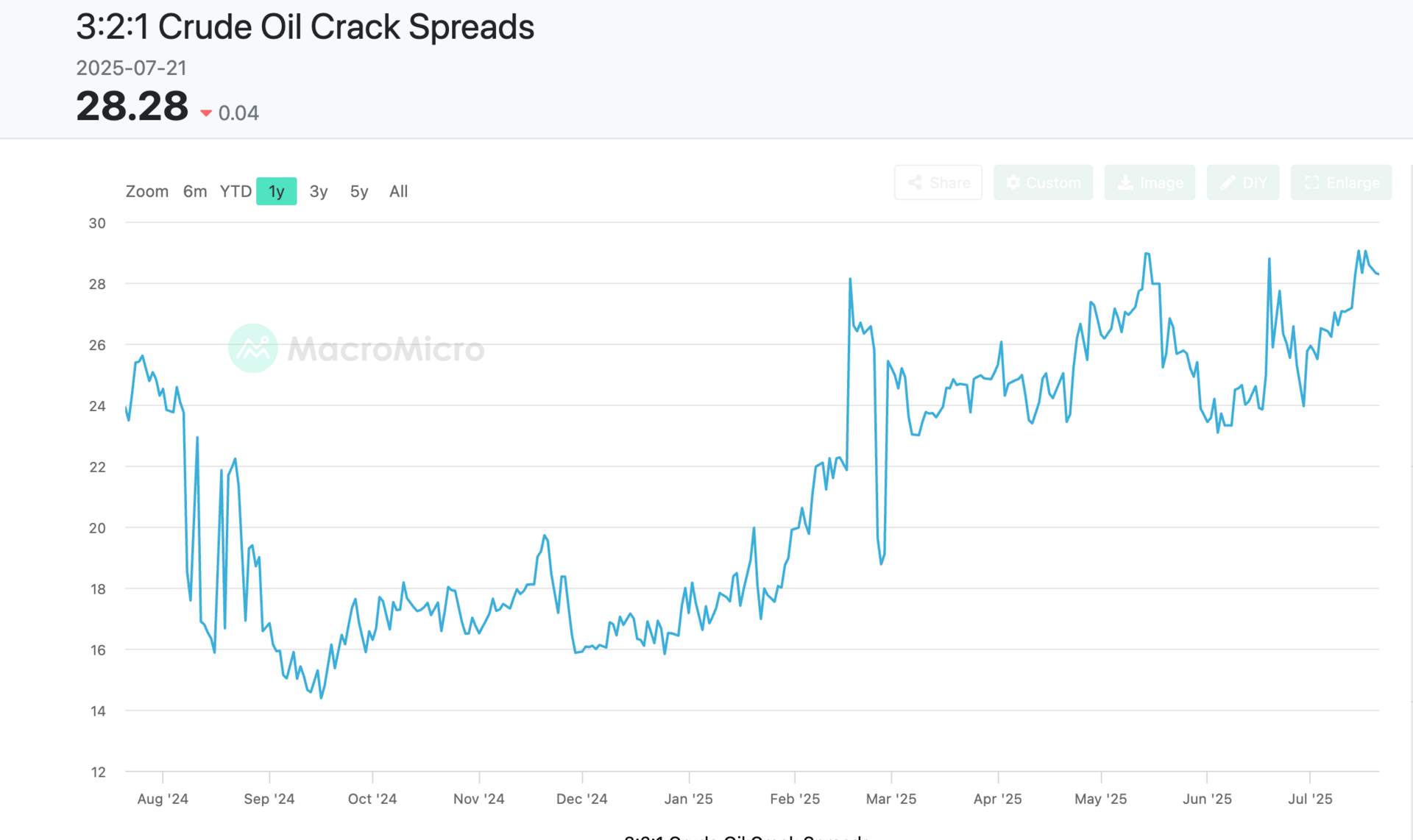

Downstream our world of refining and distribution—faces "crack spreads," the gap between crude oil costs and what we get for refined products like gasoline and diesel. The 3:2:1 crack spread ($28.28/bbl) is the profit margin from turning three barrels of crude oil into two barrels of gasoline and one barrel of diesel. It's higher, driven by seasonality upticks, strong diesel demand, and tight supplies, despite softer gasoline markets.

View full Analysis here

Right now, being downstream is looking strong with high margins for profit. Higher Profits: With crude oil at ~$66/bbl (Brent mid-July 2025), this spread adds significant value. For example, refining three barrels of crude (~$198) could yield products worth ~$226.28 (before other costs), a solid margin.

Diesel Strength: The spread benefits from strong diesel cracks (~$14-22/bbl regionally), driven by low inventories (e.g., East Coast ~21.5 million bbl below averages) and transport demand, as seen in Gulf Coast data ($14.28-22.70/bbl).

Market Opportunity: Higher spreads, especially in export-heavy regions like the Gulf (93.5% utilization), allow wholesalers to capitalize on arbitrage and global demand.

Wholesalers like you are pivoting: building customer ties with fuel cards and analytics, optimizing prices digitally, and eyeing sustainable fuels to lock in loyalty. But challenges loom—geopolitical tensions, refinery shutdowns dropping capacity 3%, and biofuel policy flips could spike costs in the next six months. Stay alert: low inventories might hike diesel prices, while overcapacity softens gas margins.

Optimism shines through. Mergers create scale for cost cuts, and tech like AI could transform ops think predicting inventory or spotting arbitrage in diesel highs. Historically tech-shy? Start small: pilots show 10-20% savings, easing resistance with training. Curious? Check Prosperous AI technology for ideas on blending tools like IoT for real-time tracking without overhauling everything.

Historically tech-shy? Start small: pilots show 10-20% savings, easing resistance with training. Curious? Check Prosperous AI technology for ideas on blending tools like IoT for real-time tracking without overhauling everything.

Here's the regional scoop to guide your ops:

Regional Breakdown of Downstream Oil & Gas Trends in 2025: Incorporating Crack Spreads

Building on national downstream trends, this breaks down key dynamics by U.S. region in 2025, focusing on refining, distribution, crack spreads (with lower gasoline cracks from soft demand and higher diesel/distillate margins from supply tightness and recovery), wholesaler observations, and strategies for adopting a technology-first mindset. Data reflects July 2025 conditions, with U.S. refining utilization at ~86-93% (down seasonally), national 3-2-1 crack spreads averaging ~$27-29/bbl (up slightly week-over-week but below peaks), gasoline cracks softer (~$8-13/bbl regionally) due to EV adoption and efficiency, and diesel cracks stronger (~$14-22/bbl) from low inventories and demand recovery. Overall downstream market growth is projected at 4.2% CAGR to $26.2 billion by 2032, driven by infrastructure and exports, but regional variations arise from capacity changes, demand patterns, and geopolitical factors.

Region | Key Trends and Observations (Including Crack Spreads) | Implications for Downstream Players | What Wholesalers Are Seeing & Tech-First Strategies |

|---|---|---|---|

West (PADD 5: CA, WA, OR, NV, AZ, AK, HI) | Refining margins tightening from overcapacity but bolstered by closures (e.g., 17% capacity reduction by 2026, including potential shutdowns); gasoline cracks lower (~$8-10/bbl) due to high EV adoption and efficiency, diesel cracks higher (~$20-22/bbl) from low inventories; utilization ~90%, but prices elevated (gasoline $4.041/gal, diesel $4.498/gal); focus on biofuels and LNG exports amid sustainability push. | Shift to diesel/high-margin products; invest in upgrades for heavier crudes/biofuels to counter gasoline weakness; risk of higher retail prices (up 15 cents/gal from closures). | Wholesalers face supply tightness and volatility from closures, with higher diesel margins offering buffers but gasoline demand lags; adopt AI/IoT for predictive inventory and dynamic pricing pilots to overcome resistance, starting with ROI-focused tools for 10-20% cost savings in hedging lower gas cracks. |

Southwest (PADD 4 + SW PADD 3: CO, UT, WY, MT, ID, NM) | Moderate growth in refining; gasoline cracks softer (~$9/bbl) from regional demand stability, diesel stronger (~$16-18/bbl) due to transport needs; utilization ~85-90%, prices mid-range (gasoline ~$3.128/gal in PADD 4, diesel $3.713/gal); emphasis on Permian ties and renewable integration. | Diversify into low-carbon fuels; leverage upstream synergies for cost control amid margin pressures. | Wholesalers see arbitrage opportunities in diesel but challenges from maturing fields; use phased ML for crack forecasting and VMI to build resilience, with leadership training to address cultural inertia. |

Gulf (PADD 3: TX, LA, MS, AL, AR) | High activity but margins under pressure (USGC cracks down, distillate weak); gasoline cracks low (~$8.77/bbl), diesel higher (~$14.28-22.70/bbl) from exports and tightness; utilization 93.5%, lowest prices (gasoline $2.738/gal, diesel $3.403/gal); maintenance peaks at 1.12 million b/d, distillate output down 2.3% y-o-y. | Pivot to diesel/LNG for margins; M&A for scale amid $6/bl Q4 margins; benefit from above-average Gulf cracks. | Wholesalers observe export-driven volatility and low inventories; implement big data for regional arbitrage on diesel highs, with governance to secure adoption despite legacy systems. |

Midwest (PADD 2: IL, IN, IA, KS, KY, MI, MN, MO, NE, ND, OH, OK, SD, TN, WI) | Utilization below 90% since mid-January; gasoline cracks moderate (~$9-11/bbl), diesel firm (~$15-20/bbl); prices (gasoline $3.033/gal, diesel $3.733/gal); biofuel uncertainties and labor constraints. | Optimize for distillates; circular economy in petrochemicals to offset gasoline softness. | Wholesalers contend with demand stability but policy shifts; leverage IoT for maintenance and crack modeling pilots to demonstrate value and upskill teams. |

East (PADD 1A/B: CT, ME, MA, NH, RI, VT, DE, DC, MD, NJ, NY, PA) | Low utilization (~59% historic lows); gasoline cracks contracted (~$8/bbl), diesel higher (~$16-18/bbl) from imports; prices (gasoline ~$2.987/gal in PADD 1, diesel $3.793/gal); regulatory push for electrification. | Import reliance; integrate hydrogen for compliance and margins. | Wholesalers see inventory lows (~21.5 million bbl below averages) driving diesel premiums; use analytics for green sourcing and phased rollouts to navigate resistance. |

Southeast (PADD 1C: FL, GA, NC, SC, VA, WV) | Demand growth offsetting declines; gasoline cracks soft (~$8-9/bbl), diesel strong (~$15-17/bbl); prices aligned with PADD 1 (~$2.987/gal gasoline, $3.793/gal diesel); focus on resilient chains amid hurricanes. | EV charging diversification; tech for compliance in low-carbon shifts. | Wholesalers face geopolitical risks; adopt real-time platforms for diesel arbitrage, with people-centric training to foster buy-in. |

South (Overlapping southern states: AL, MS, TN, KY, etc.) | Blended trends from Gulf/Midwest; gasoline cracks lower (~$8-10/bbl), diesel higher (~$14-20/bbl); prices vary (e.g., Gulf $2.738/gal gasoline, Midwest $3.033/gal); investments in supply chains and hydrogen. | Portfolio diversification; capitalize on domestic energy policies. | Wholesalers prioritize sustainability amid reserve issues; integrate automation for margin tracking, emphasizing executive support for transformation. |

Looking ahead, embrace change—tech could unlock hidden edges. Explore Prosperous AI technology to spark ideas for your ops. Stay vigilant, stay prosperous.

Are you interested in our technology? Try it for free for our newsletter subscribers only below